OFFICE HOURS

When: Thursdays 3-5 pm

Where: 7512 E Independence Blvd, Charlotte, NC

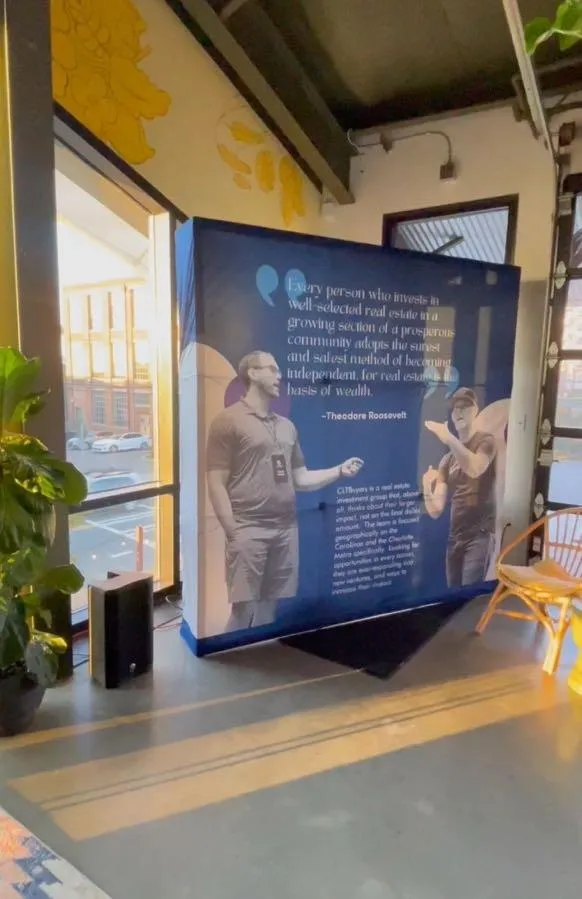

Join us every week for CLT Buyers’ free community Office Hours, an open and welcoming space where homeowners, investors, and real estate enthusiasts come together to learn, share, and connect. Since launching this initiative in 2020, we’ve built a trusted environment where people from all walks of life can find personalized education, property guidance, and real-world support, all at no cost! Whether you’re a first-time home seller, an experienced landlord managing multiple rental properties, or simply curious about how the real estate market works, our team is here to provide clarity and honest advice.

At Office Hours, you’ll find practical, actionable insights on topics like selling your house fast for cash, evaluating investment properties, understanding the closing process, handling inherited homes, and navigating property repairs or tenant challenges. We don’t just talk theory; we walk you through real scenarios happening in the Charlotte, NC real estate market, giving you the tools and confidence to make informed decisions.

Each week, the group ranges from 10 to 30 friendly faces, sometimes more, creating a diverse mix of perspectives. You’ll meet neighbors curious about selling, out-of-state investors looking for local opportunities, landlords with tenant questions, and seasoned experts happy to share their knowledge. It’s a relaxed, judgment-free environment designed to encourage conversation and build relationships. Many attendees drop by for quick answers, while others stay the full session to network, brainstorm, and collaborate on potential deals.

The best part? You don’t need to prepare or commit to anything, just stop by and say hello! Every question is welcome, and every conversation is valuable. Over the years, Office Hours has become more than an event; it’s a growing community resource for Charlotte homeowners and real estate professionals. Whether you’re considering selling your house, exploring investment strategies, or simply curious about the market, you’ll leave with practical takeaways, new connections, and the confidence to take your next step in real estate.

THE EXCHANGE

When: 2nd Thursday of each month Where: Hopfly Brewery, Charlotte, NC

Since 2017, The Exchange has grown into Charlotte’s premier monthly meetup for real estate professionals, investors, homeowners, and anyone with an interest in the local housing market. What began as a small gathering has become a cornerstone event in the Charlotte real estate community, regularly drawing 50 to 100 attendees each month. Whether you’re an experienced investor with years of deals under your belt, a homeowner exploring your options, or someone brand new to real estate, The Exchange offers an inclusive and engaging environment designed to educate, connect, and inspire.

Each month, we feature informative speaker presentations that dive into timely topics shaping the Charlotte and North Carolina markets. Past sessions have explored subjects like navigating the foreclosure process, financing investment properties, market trends across Mecklenburg and surrounding counties, tax strategies for landlords, creative deal structures, and the future of real estate investing in a changing economy. Our speakers include trusted local professionals, attorneys, lenders, property managers, investors, and industry experts; who share actionable insights you can apply immediately to your business or personal real estate goals.

After the presentations, the event transitions into casual networking at Hopfly Brewery, one of Charlotte’s most welcoming community hubs. Here, you’ll find a laid-back environment perfect for building genuine connections. Attendees often strike up conversations that lead to partnerships, deals, mentorship opportunities, and lasting friendships. With a diverse crowd ranging from first-time investors to seasoned developers, every Exchange is a chance to broaden your network and gain perspectives you won’t find anywhere else.

Best of all, The Exchange is completely free and open to everyone. There’s no pressure, no hidden agenda, just a commitment to creating a space where people can learn, collaborate, and grow together. Whether you’re looking to sell a home, expand your investment portfolio, or simply keep up with Charlotte’s fast-moving real estate market, The Exchange is the place to be. Come for the insights, stay for the connections, and leave with both knowledge and community you can count on.

Inventory Games: Charlotte’s Housing Shortage and Silver Linings

The Undersupply Story

Charlotte’s inventory woes didn’t happen overnight. Pre-2020, we averaged 10k+ active listings. Then came the pandemic housing craze, and active listings plummeted to ~2,800 by 2022 – an absurdly low number for a metro of this size . New construction couldn’t keep up (thanks to supply chain snags and labor shortages), and homes were selling faster than David Tepper sells first round draft picks. Fast forward to 2024: inventory climbed back to about 3,200 listings . Better, yes, but still way below what a traditionally healthy market requires. For context, many housing experts consider ~6 months of supply balanced; Charlotte sits around 1.6 months today.

That’s an extreme seller’s market by definition.

Why Tight Supply = Opportunity

It sounds counterintuitive, but low inventory can be good for investors. Fewer listings mean less competition when you put a property up for rent or sale – demand is basically built in. With so many buyers chasing so few homes, prices have been resilient. Even as the market “cools,” undersupply props up values. For a buy-and-hold investor, that steady or rising equity is gold. Plus, renters who are facing limited home purchase options will end up staying in the rental pool longer, boosting rental demand for your units. The key is finding deals in this tight market.

How?

Look OFF-MARKET for the motivated seller, the “ugliest house on the block” needing TLC; or, expand your search radius to outlying counties where inventory is improving faster (think Gaston and Cabarrus). Those who think outside Mecklenburg County can still find reasonably priced properties amid the crunch, especially if they’re willing to engage directly with a potential seller.

Overhyped Areas vs. Hidden Opportunities

In an inventory squeeze, everyone flocks to the same hotspots – South End condos, Ballantyne townhomes, you name it. The result? Those areas get picked clean and bid up. As a contrarian play, consider less obvious locales. Is that McMansion out in Monroe sitting longer than usual? Perhaps an opportunity to snag it below market pricing. Or maybe a fixer-upper in West Charlotte that scared off retail buyers could be your diamond in the rough. Maybe you drive around a neighborhood you’re interested in and talk to neighbors who may have insight on potential opportunities. In a market where everything seems in short supply, the real strategy is to target segments that are a little less picked over. We’ve noticed luxury-tier homes ($1M+) actually have more inventory nowadays (owners in this bracket aren’t as desperate to sell fast). If you have the capital, negotiating on a high-end property could yield a discount and a big long-term upside once supply normalizes.

Silver Linings and New Construction

Homebuilders know there’s money on the table and have been ramping up projects, especially in the suburbs. Drive through Union County or York County, and you’ll see new subdivisions popping up. This new construction is a welcome relief, gradually expanding supply. It’s still not enough to erase the deficit, but it’s a start. Also, keep an eye on built-to-rent communities sprouting around University City and elsewhere – they add rental supply, but not for-sale inventory, which keeps resale home supply tight. For investors, these new homes might present turnkey rental options with lower maintenance, albeit at a price premium. The inventory game in Charlotte is all about patience and creativity. The stock may be low, but the upside is high if you can secure a foothold now before the builders catch up in a few years.

Struggling with Charlotte’s low inventory? We’re here to help you find the hidden deals. Visit our website for off-market opportunities, follow us for weekly deal spotlights, or send us a message to get personalized tips on navigating this inventory crunch. Let’s turn this challenge into your competitive edge!